California Proposition 15, the Tax on Commercial and Industrial Properties for Education and Local Government Funding Initiative, is on the ballot in California as an initiated constitutional amendment on November 3, 2020.

PROP 15 BILL SUMMARY

Proposition 15 would amend the California State Constitution to require commercial and industrial properties, except those zoned as commercial agriculture, to be taxed based on their market value. In California, the proposal to assess taxes on commercial and industrial properties at market value, while continuing to assess taxes on residential properties based on the purchase price, is known as split roll.

The change from the purchase price to market value would be phased-in beginning in the fiscal year 2022-2023. Properties, such as retail centers, whose occupants are 50% or more small businesses would be taxed based on market value beginning in the fiscal year 2025-2026 (or at a later date that the legislature decides on). Proposition 15 would define small businesses as those that are independently owned and operated, own California property, and have 50 or fewer employees.

The ballot initiative would make an exception for properties whose business owners have $3 million or less in holdings in California; these properties would continue to be taxed based on their purchase price. The ballot initiative would exempt a small business’s tangible personal property from taxes and $500,000 in value for a non-small business’s tangible personal property.

REVENUE DISTRIBUTION

The state fiscal analyst estimated that, upon full implementation, the ballot initiative would generate between $8 billion and $12.5 billion in revenue per year. The ballot initiative would distribute the revenue to specific areas, rather than the General Fund.

I- The revenue would be distributed to:

• the state to supplement decreases in revenue from the state's income tax and corporation tax due to increased tax deductions and

• Counties to cover the costs of implementing the measure.

II- 60% of the remaining funds would be distributed to local governments and special districts, and 40% would be distributed to school districts and community colleges (via a new Local School and Community College Property Tax Fund).

Revenue appropriated for education would be divided as follows: 11% for community colleges and 89% for public schools, charter schools, and county education offices. There would also be a requirement that schools and colleges receive an annual minimum of $100 (adjusted each year) per full-time student.

NEGATIVE IMPACT ON REAL ESTATE, SMALL BUSINESSES, & COST OF LIVING

PROP 15 REPEALS PROP 13 PROTECTIONS

Prop. 15 would undo valuable taxpayer protections provided by California’s landmark Prop. 13 that was passed in 1978. Prop. 13, among other changes, implemented a predictable, stable property tax regimen in California, where commercial and residential properties are taxed at 1% of their purchase prices, and increases in property tax are capped at 2-% a year from that purchase-price valuation.

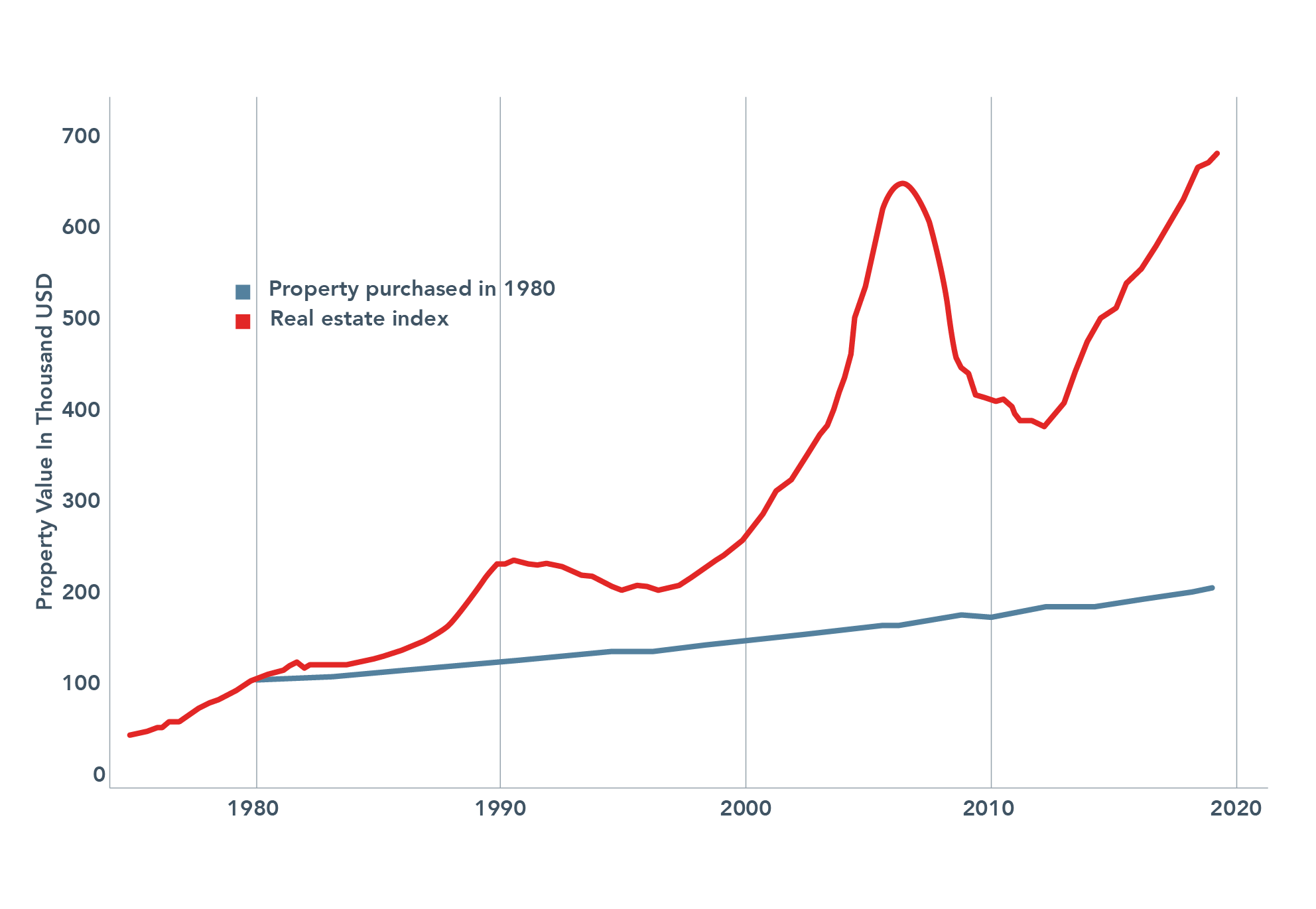

The Graph below illustrates how the property tax increases over time for a hypothetical property sold in 1980, and shows how the assessed value of the property

can diverge from the property’s market value.

UNPREDICTABLE PROPERTY TAX SPIKES

Under Prop. 15, many commercial properties would be subject to reassessment annually, or at least every three years, opening the door to the unpredictable property tax spikes that forced seniors out of their homes in the 1970's and contributed to the taxpayer revolt that ended in the passage of Prop. 13. It is referred to as “split roll” because it would lead to different treatment of residential and commercial properties in the property tax roll.

HURTS SMALL BUSINESSES

A majority of small businesses have lease or rental agreements allowing increases if the large corporate real property owner has a tax increase - this property tax cost is then passed on to these small businesses (lease or rent) holders. This new expense for small businesses is now passed to the general public as higher costs of goods and services.

INCREASES COST OF LARGE COMMERCIAL DEVELOPMENTS

Prop. 15 would also increase the long term cost of large commercial real property developments and discourage new businesses to build new commercial properties. Many large companies would simply build developments in other states, while others would move from California to avoid high property taxes and assessments.

UNSTABLE PROPERTY COSTS

Prop. 15 degrades the original intent of Prop. 13 - passed years ago - that keeps real property taxes stable; these stable increases of 2 per-cent per year, allow business owners- both small and large businesses- a stable way to calculate future property tax costs. The state and local agencies, now under Prop. 13 can increase the assessed value of the real property by 2% per year. This is a substantial amount as after 10 years the assessed increase would be 20%, 20 years 40%, 30 years 60%, and progresses, so on, over time.

HURTS HOMEOWNERS AND RENTERS

Prop 15 will make the housing crisis even worse by increasing the costs of owning and renting a home – it could even force people out of their homes, like what happened before the voters passed Prop 13 in 1978.

INCREASES COST OF LIVING

Californians already pay property and other taxes to fund: schools, cities, counties, and the state government.

Prop 15’s tax hike on businesses will ultimately get passed on to consumers in the form of increased costs on just about everything people buy and use, including:

• Groceries

• Fuel

• Daycare

• Health care

• Utilities