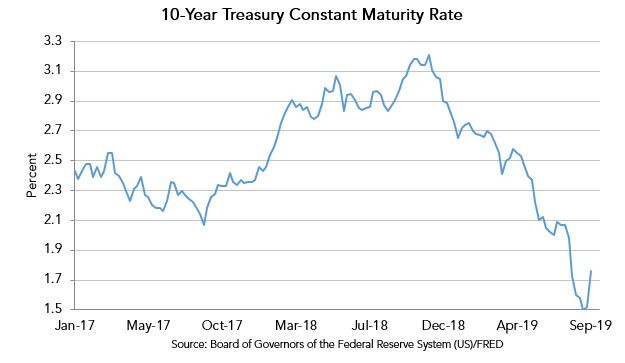

As expected, the Fed cut rates another quarter-point, taking its overnight lending rate to a target range of 1.75% to 2%. The global economic picture continues to be clouded as growth slows in large economies across Europe and Asia. Ongoing trade disputes - along with Brexit, heightened Middle East tensions, and other geopolitical risks - are weighing on economic growth. In the U.S., inflation remains subdued - giving the Fed flexibility to take a more accommodating policy stance - and both GDP and employment growth have slowed. Today’s rate cut reflects the Fed’s response to an evolving economic landscape. This is problematic for the consumer as lower borrowing costs are offset by the corresponding reduction in investment returns.

The committee quoted “the implications of global developments for the economic outlook as well as muted inflation pressures” as the basis for the decision. Inflation projections are unchanged at 1.8% for 2019 and 2.5% over the longer run. The committee was deeply divided. Five members thought the FOMC voted to hold the rates at its previous range of 2% to 2.25%. Five approved of the 25 basis point cut at the condition to keep the rates steady through the rest of the year. Seven favored at least one more cut this year.

According to The FOMC, these cuts are a “midcycle adjustment,” a more aggressive strategy to drive rates down. This riled the markets, with many hoping for a more accommodating stance and additional cuts near-term.