• Tariffs and trade disputes continue to dominate the headlines, While the recent news that Mexico and the US have agreed to a deal, China is still a big question. Central banks are concerned about the U.S. and global economic strength and stability. Australia recently cut their rates to all-time lows, while the ECB is offering record low rate loans and may cut rates soon as well.

• Recent comments by Fed chairman Powell makes it clear they are poised to cut rates to sustain expansion, but how much; and how many times?

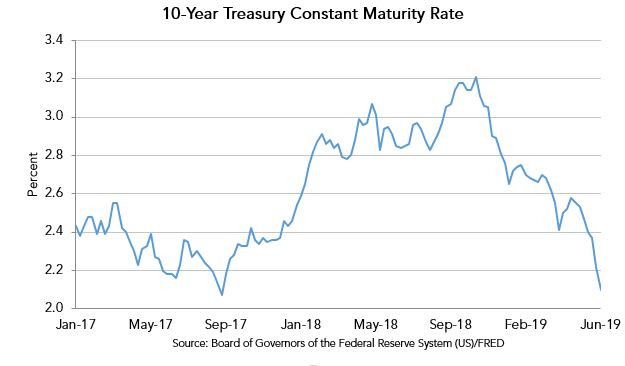

• The recent decline in U.S. Treasuries and corresponding SWAP rates are a result of the market unwinding the expectation of Fed rate increases and pricing in at least one rate cut this year. CRE owners have a rare opportunity to lock in attractive long term rates and realize return expectations immediately.