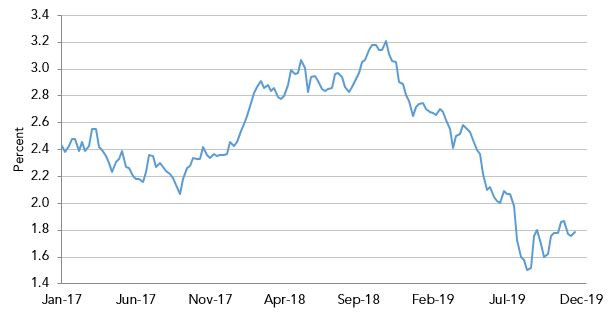

The Federal Reserve's Open Market Committee has announced that the 2019 rate cuts were sufficient to stabilize the economy and lower the risk of a recession, thereby eliminating the need for additional cuts in 2020. They believe the inflation is in line with its targeted 2% level, and that the current monetary policy is responsible for the economic expansion and healthy labor market.

The Fed has forecasted that in 2020 unemployment will stay at or below current levels, inflation will remain below the 2% targeted rate, and GDP growth will stay in the 2% range. The financial markets are in disagreement with these predictions and think that the Fed will need to cut rates next year.

We believe the real estate market will continue to be strong. Rates will stay at or near record lows. Equity funds have raised a record amount of investment capital as they view real estate as the safest and least volatile investment. Any dip in the economy will be soft and short-lived as economic conditions continue to be strong in the “new normal” economy.