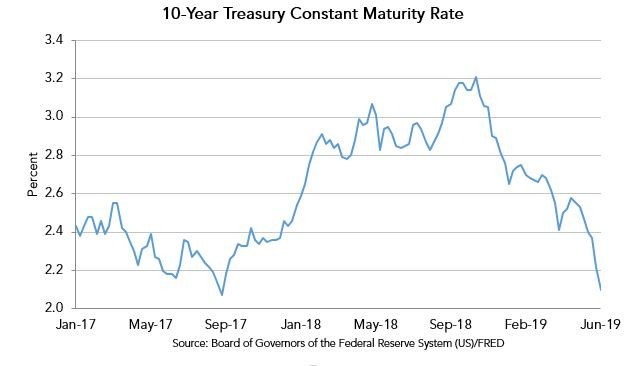

The results of this week’s FED meeting combined with the ECB announcing potential rates cut(s) or quantitative easing signals that another round of rate cuts is imminent. There is little to no evidence of inflation and combined with full employment and damaging trade disputes the market is pressuring the FED to accommodate. Futures and equities have priced in cuts in July and September, so a lack of action by the FED would be very disruptive.

Our clients are taking advantage of this unexpected gift of lower rates and refinancing current assets to balance out their portfolios. Potential acquisitions are modeling better, and there is renewed activity across the board.